TEL AVIV, ISRAEL – 20th August 2020 – Leading corporate travel data platform, FairFly, today unveils a new, publicly available “Airfare Price Volatility Index” giving travel managers a wide-angle lens and insights into airline pricing activity.

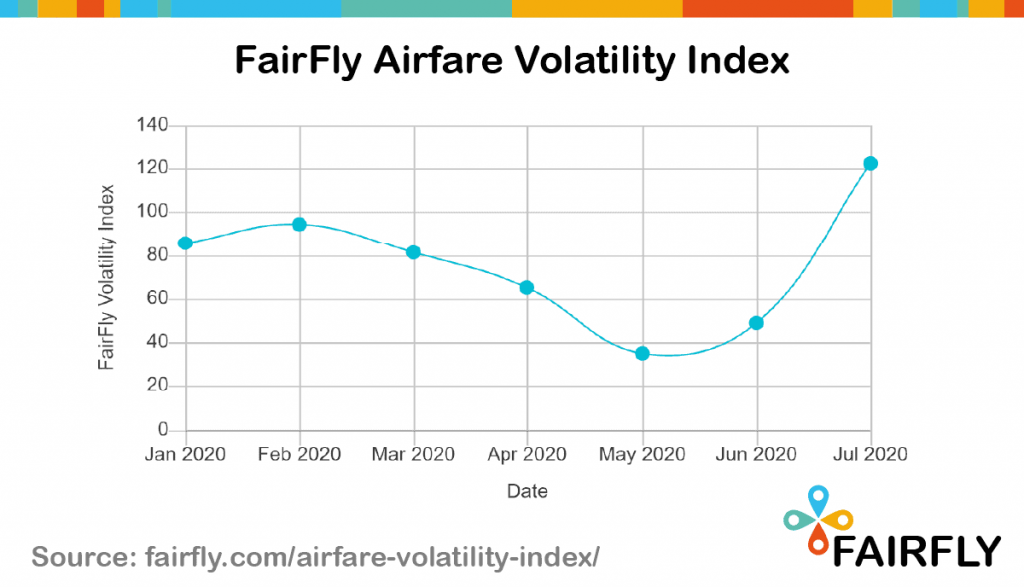

Versus June, July 2020 saw a staggering uptick in the price volatility by 152%, with the index jumping from 48.7 to 122.6 in one month. By comparison, the second-highest month by volatility was back in February recording an index value of 94.8. Typical volatility in 2019 ranged from between 60 and 80.

Such a high and rapid rise in July’s airfare price volatility shows a market struggling to come to terms with daily shifts in supply and demand compounded by airlines seeking to mitigate large losses. Without a price assurance solution implemented as part of a corporate travel management program, there is a much higher risk of overpaying for air travel.

The index tracks relative volatility rather than absolute price fluctuations. This is to standardize the appetite airlines have for how far they increase or decrease prices in the current climate to manage load-factors with revenue. A value of zero would mean static pricing for the period.

Millions of fares have been analyzed by the FairFly data platform to track variations between fare filing. These data points have been combined and standardized to provide a monthly metric to the corporate travel industry showing how airlines are pricing fares given the wild fluctuations in supply and demand in the travel industry.

This is a significant step forwards in understanding how airline revenue management systems are responding to both the strain of current market conditions and the pressure to mitigate and recoup significant 2020 losses caused by COVID-19 travel restrictions.

“It’s in our DNA to analyze and understand travel data for our customers so that they can make more informed decisions,” said Aviel Siman-Tov, CEO and Co-Founder at FairFly. “The travel industry is in a state of flux, and travel managers deserve to have as much up-to-date information on potential factors that impact the resumption of their travel programs. We don’t think it’s fair that corporate travel budgets should take the brunt of airline price instability.”

“From a financial perspective, added price instability is the worst-case scenario for a CFO when planning budgets as companies recover and need to get back on the road. FairFly’s FareSaver has typically yielded industry-leading savings of around 4% but looking forwards we can see that jumping to 6 or maybe 8%.”

Corporates with an airfare price tracking tool will see far more opportunities to reduce unnecessary expenditures as they seek to capitalize on the competitive advantage afforded by face-to-face sales and account management efforts.